|

MIXED YEAR

The year 2012-2013 was a

mixed year for the UPS industry. Some companies grew while others failed

to do so. The industry netted revenues to the tune of INR 4653 crores.

This is exclusively the end-user sales figure. However the over all

industry revenue was estimated at INR 4853 crores. The reason why the

total industry revenue is much higher then the actual end-user sales is

because many a companies procure finished products from others & brand

them as theirs, and our survey team gets the turnover from both, resulting

in duplication. With nearly 354 companies responding to our survey, giving

us the information we sought in great detail, knowing fully well how much

the company has manufactured with excise paid. And also trying to find

out, which companies procure finished products from others & brand

them as theirs, an exercise which We have been doing only since last four

years, we did all of it again to give continuity to the process.

Out of 354 companies responding only 181 companies were

awarded with SD Ratings.

However most of companies are facing it difficult to

match quarter to quarter sales of 11-12 in 12-13. We are sure the figure

which we have arrived at i.e. the actual end-user sales revenue of has

definitely crossed INR 4653.00 crore mark .

Growth wise it has not been a mixed year with some of

the majors growing while others dipping.

Revenue-wise : This year 2012-13, the industry grew by

5.15% & revenues grew up to 4653 crores, a dip of over 6.6% over the

last fiscal of 2011-2012. When it has grown by 7.34%.

Volume-wise : Industry grew by 18% over previous year

in volume terms. This clearly indicates shrinking margins. Drops in

revenues while increase in volume.

One must be clear in mind that this is a very good

performance considering the stiff competition and the squeezed margins in

view of hammering the companies got during the global economic meltdown

& falling Indian Rupee.

Of the total revenue of 4653 crores, Online UPSs

accounted for 93% while Offline / Line interactive UPSs accounted for

nearly 5% while other products including Servos accounting for the rest.

We have not included the Home UPS sales figure in this.

Of the total revenue organized sector accounted for

nearly 65% while 27% came through semi organized sector while 18% share

still remains with the unorganized fly by night operators.

SD FINDINGS

Softdisk went about finding the state of the industry

and also how deep they were actually effected by recession, The first two

quarters of the financial year 2013-14 were just ok. Probably pumped by

Govt. buying. However ITES companies like Call centers are badly hit. The

overall effect is putting expansion plans on hold. They have given more

stress on best utilization of their existing facility and infrastructure.

Almost flat growth for big IT companies. However, the growth continued to

some extent in telecom segment. The large telecom data center business

though slowed down in pace, however, exhibiting positive trends. The

telecom segment even during recessionary trend continued its positive

trend for tower infrastructure. This has kept mid segment market for UPS

going well (up-to 200KVA). A small power data center with power

requirement of 20, 60, 200KVA rating are also going as per plans. The

Industrial market segment covering Power, Energy, Manufacturing, Steel,

Cement, Oil & Gas, always experienced steady and normal growth of

12-14%. The same is continuing in this year. Softdisk believes that more

and more people are moving towards Solar. Solar PCUs units are the new

mantra for the UPS Companies, some have even manufactured and installed

Solar UPS, with hybrid charge facility (Photovoltaic & Mains).

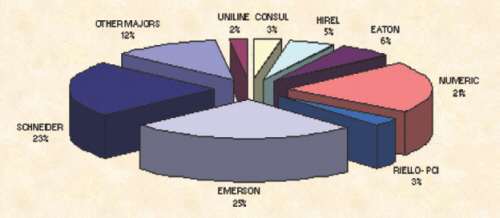

With consolidation being the mantra for Industry. One

can say the entire Online UPS market can be divided into following

APC-Schneider, Emerson (Chloride & DB), Eaton, Numeric selling its UPS

Business Unit to Novateur, Reillo PCI, Socomec, Delta & Uniline, Other

Major players (Hi-Rel, Consul, Power One, Tritronics, Techser & Hykon)

& the rest. Talking of market share Emerson has the highest market

share of 25.5% followed closely by APC Schneider 22.5, Numeric 21%, Eaton

6%, Riello PCI 3% while other major players account for 12%.

SD ESTIMATES

Softdisk had predicted in July 2012 that the total

industry revenue will cross INR 5000 crore mark by March, 2013. We talked

ti Industry Captains trying to know what the Industry leaders thought.

Many had little or no doubt to what Softdisk has predicted earlier, even

though this response was at time when the global economies were trying to

come out of worst ever economic crises, and Indian market was also shaken

by it. As on date we feel that nearing 4850 crore mark for end-user sales

and 5100 crore mark including secondary sales is quite possible. Although

few may disagree to the secondary figures, but being optimistic has always

been the Softdisk attitude.

To the SD’s question 2012-13 Market was slow, But

first two quarters are showing steady progress nothing flashy, is the weak

rupee against the US$ impacting?

According to Mr. N K Agrawal of Delhi based Microtek in

2012-13 market had been not very buoyant, This financial year the economy

world over is moving under the shadow of fear of major recession in US and

Europe, because of this the things have slowed down, it will not impact

Indian markets but spillover effect is showing its sign the falling rupee

is one such sign. In-spite of all this we still feel that the UPS Segment

will show a growth in this year also, he laments. (Here it is worth

mentioning that Softdisk figure does not include the revenue generated by

Inverters) According to Mr. N K Agrawal of Delhi based Microtek in

2012-13 market had been not very buoyant, This financial year the economy

world over is moving under the shadow of fear of major recession in US and

Europe, because of this the things have slowed down, it will not impact

Indian markets but spillover effect is showing its sign the falling rupee

is one such sign. In-spite of all this we still feel that the UPS Segment

will show a growth in this year also, he laments. (Here it is worth

mentioning that Softdisk figure does not include the revenue generated by

Inverters)

While Mr. Cristo George, MD of Thrissur, Kerela based

Hykon India Pvt. Ltd. believes that after experiencing severe declines

following the global recession in 2009, this is a repeat. As most of the

components of UPS are importing, the cost of UPS will go up due to the

increased Dollar rates. It is also good for Indian UPS manufacturers as

the cost of finished UPS from China will be increased further. So time has

reached for the Indian manufacturers to mass produce the UPS below 5KVA

instead of depending on the China Import. While Mr. Cristo George, MD of Thrissur, Kerela based

Hykon India Pvt. Ltd. believes that after experiencing severe declines

following the global recession in 2009, this is a repeat. As most of the

components of UPS are importing, the cost of UPS will go up due to the

increased Dollar rates. It is also good for Indian UPS manufacturers as

the cost of finished UPS from China will be increased further. So time has

reached for the Indian manufacturers to mass produce the UPS below 5KVA

instead of depending on the China Import.

We are doing exceptionally well in SME (20 to 60 kVA)

segment. Uninterruptible Power Supplies grew twice as fast in the second

half of 2012-13 compared with the first half of that year. The market

continues to recover swiftly from the economic downturn with revenues in

3rd quarter of 2012-13 being 10.8% higher than the same period in 2011.

Even the JFM quarter of 2013 was good, he laments. We know our strengths

and don't over reach and as such we are not effected that much by the

falling rupee.

Mr. R K Bansal Managing Director Uniline Energy Systems

Pvt. Ltd. elaborated on this issue, according to him when we speak about

market, we have an enterprise market segment in mind. Most of the top

notch UPS companies like APC, Eaton, Numeric etc to some extent mostly

serve this business segment. Our strength lies in Govt. sector & PSUs.

As per our understanding, the market segment revenue (excluding precision

A/C, Electrical distribution, etc.) for UPS Systems is close to INR 4500

Cr. Looking at the present market scenario, the revenue collection from

this segment shall be within INR 5000 to 5100 Crore in the current fiscal

this year. We have already crossed INR 100 Crore in revenue and are

gunning for 200 Crore in the next two years. Mr. R K Bansal Managing Director Uniline Energy Systems

Pvt. Ltd. elaborated on this issue, according to him when we speak about

market, we have an enterprise market segment in mind. Most of the top

notch UPS companies like APC, Eaton, Numeric etc to some extent mostly

serve this business segment. Our strength lies in Govt. sector & PSUs.

As per our understanding, the market segment revenue (excluding precision

A/C, Electrical distribution, etc.) for UPS Systems is close to INR 4500

Cr. Looking at the present market scenario, the revenue collection from

this segment shall be within INR 5000 to 5100 Crore in the current fiscal

this year. We have already crossed INR 100 Crore in revenue and are

gunning for 200 Crore in the next two years.

Even after a year of slump, economic slow down has

adversely affected IT and IT infrastructure segment. The expansion plans

are put on hold by most of the big names in IT, ITES. Even the aggressive

companies in IT infrastructure segment are no exception. There is more

emphasis on best utilization of existing IT facilities and also human

resource. Even the Data Centers projects in telecom segment with few

exceptions are either postponed or put on temporary hold. However we see a

shift now, In last six months the demand for high power UPSs above 200KVA

has gone up considerably. The situations now is wait and watch and do the

things as they unfold. As of Uniline the economic recession has not

affected. We expect more business from these segments and continue to

maintain our growth. Apart from this, some business revenue is also

expected from specialized Solar products what we manufacture for niche

market.

Fluctuation in rupee price not only raise imports bill

but also lead to volatility affecting their businesses. Due to increase in

raw material cost, depreciating value of Indian Rupee, increase of excise

duty from government side the overall input cost has increased.

Considering the above facts, companies have increased their product

pricing. Local vendors cannot be matched up with multinationals as they

are not up to the mark in terms of international standards, quality etc.

Delta follows the concept of economy of scale ensuring right product and

right quality. Delta also has its local manufacturing unit at Rudrapur and

Gurgaon. Delta Power Solution’s manufacturing plant at Rudrapur, India

(first Green manufacturing facility in India) has a capacity of

manufacturing UPS up to 4000 kVA along with battery banks, harmonics

filters, accessories and allied products to provide an end to end power

backup solution. UPS assembly line is equipped with Fluctuation in rupee price not only raise imports bill

but also lead to volatility affecting their businesses. Due to increase in

raw material cost, depreciating value of Indian Rupee, increase of excise

duty from government side the overall input cost has increased.

Considering the above facts, companies have increased their product

pricing. Local vendors cannot be matched up with multinationals as they

are not up to the mark in terms of international standards, quality etc.

Delta follows the concept of economy of scale ensuring right product and

right quality. Delta also has its local manufacturing unit at Rudrapur and

Gurgaon. Delta Power Solution’s manufacturing plant at Rudrapur, India

(first Green manufacturing facility in India) has a capacity of

manufacturing UPS up to 4000 kVA along with battery banks, harmonics

filters, accessories and allied products to provide an end to end power

backup solution. UPS assembly line is equipped with

1. Latest equipments and fully automated test

stations to perform full range of parametric test for ratings up to 500

kVA (largest rating as single module)

2. Environment chamber to perform UPS burn- in test

at elevated temperature,

3. Variable voltage and frequency source for

testing UPS as per practical site conditions and simulating worst case

utility conditions

4. Pure resistive as well as variable power factor

load to perform UPS full load test for practically all conditions and get

rid of any infancy failure in UPS

In addition to providing technologically superior,

quality products that meets the global standards, Delta Power Solutions

local manufacturing at helps meet another dimension of business needs

today - On time and short delivery times. Current day business needs

require that projects are completed on time as projects overruns lead to

an unprecedented opportunity loss in Telecom, IT setups, Data Centers,

Medical establishments and Industry at large.

Mr. Narayan Sabhahit Managing Director, Techser Power

Systems Pvt. Ltd, Bangalore, believes that last year for many companies

which were restructuring against backdrop economic revival, it was a year

of consolidation. Slowly market is realizing that it is not just the

buying cost but long term support what is required especially in India as

people expect product-life to be atleast double compared to advanced

countries. He further adds, the UPS penetration is now taking place in

cities and towns outside the top 20 cities. According to him “Today the

development process in every vertical is witnessing a speedy growth in the

rural areas. Interpretation of word ‘development’ in its correct form,

has been taken seriously by the concerned agencies / authorities. The

Infrastructure development required to address the challenges of 21st

century is being put in to place. This is a good sign to a certain extent

Government is also keen in making efforts towards enduring availability of

Power, he laments. Mr. Narayan Sabhahit Managing Director, Techser Power

Systems Pvt. Ltd, Bangalore, believes that last year for many companies

which were restructuring against backdrop economic revival, it was a year

of consolidation. Slowly market is realizing that it is not just the

buying cost but long term support what is required especially in India as

people expect product-life to be atleast double compared to advanced

countries. He further adds, the UPS penetration is now taking place in

cities and towns outside the top 20 cities. According to him “Today the

development process in every vertical is witnessing a speedy growth in the

rural areas. Interpretation of word ‘development’ in its correct form,

has been taken seriously by the concerned agencies / authorities. The

Infrastructure development required to address the challenges of 21st

century is being put in to place. This is a good sign to a certain extent

Government is also keen in making efforts towards enduring availability of

Power, he laments.

Speaking on the overall scenario of the industry Mr.

Sabhahit believes that all this put together, there is growth pattern

happening. These are the areas where continuity of power is very

essential, since these companies are facing the Global Challenges. And

hence the demand for the UPS and Complete Power solutions is on the rise.

Mr. A Balan of Numeric UPS feels that Softdisk has more

scientific way of evaluating the market for its volume and quality then

any other agency and the overall UPS sales by 2013 might touch 5000 Cr

mark subject to IT recovery. He believes that first two quarters of

2012-13 have been OK, not that bad as projected by many. He feels that for

manufactures it is not that much of a problem, it is the week India Rupee

against US$ which is cause of concern of importers. Mr. A Balan of Numeric UPS feels that Softdisk has more

scientific way of evaluating the market for its volume and quality then

any other agency and the overall UPS sales by 2013 might touch 5000 Cr

mark subject to IT recovery. He believes that first two quarters of

2012-13 have been OK, not that bad as projected by many. He feels that for

manufactures it is not that much of a problem, it is the week India Rupee

against US$ which is cause of concern of importers.

Legrand which acquired NUMERIC brand a leader in the

UPS industry, has taken larger initiatives with most modern manufacturing

infrastructure to address the mass production requirements and

geographically expanded to over 259 locations as of now. With India

assuming a key role in Asia, businesses have become attuned to the fact

that they need robust infrastructure to attract and retain investors for

this having power continuity & quality are paramount.

On the question of Reverse Auction, Mr. A Balan was

critical : The entire industry must boycott reverse auction without any

exception. Reverse auction makes everyone to cut the others leg and their

own as well since there is pressure in the minds of the participants.

Reverse auction should be avoided as these terms enable open and

non-ethical competition wherein vendors are not rated on their financial,

technical, service capability and product reliability and are allowed to

participate with only price as the criteria. This resulted in many tenders

being scrapped and vendors who quote unrealistic rates in reverse auction

were enabled to supply and destroy the market and the industry itself.

He further adds : After all we are supplying and

installing a POWER CONDITIONING product, A CAPITAL EQUIPMENT and not a box

pushing activity. In the absence of a detailed technical selling based on

performance, reverse auction becomes a simple number game for everyone.

This will lead to killing the very industry practice itself simply and the

customers will realize this after few years later. If this is for computer

stationery (or) purchase of tube lights etc then the reverse auction is Ok

as most competitive bidder will sell more.

According to Mr. Rajaram Rammoorthy of Electronics

& Controls, Reverse Auctions have become order of the day which is

being followed by many major banks. The only way customers can be spoken

out of is by explaining the demerits of Reverse Auction and making them

understand. (1) In some tenders, customer is procuring at prices which are

higher than what they would otherwise procure in closed tenders. (2)

Customers are getting supplies which are compromised in terms of

specifications which they are unaware. On the Supplier’s side, (a) the

reverse auctions are just too time consuming, sometimes the process takes

almost a full day, (b) too much dependence on network/internet

connectivity and infrastructure issues (c) Customers themselves setting

unrealistic starting bid prices. Customers have to understand that they

should not buy at very low prices at the cost of suppliers for their own

long term benefit and realize the value for money. As mentioned, Customer

education is key and customers should be open to listening to suppliers,

which they will seldom do. Possibility is for the UPS associations to make

an honest attempt to embark on a sustained plan to educate the Customers.

Though staying away from reverse auctions is an option, a more viable

option is to stick to prices which are viable and sustainable in the long

run. According to Mr. Rajaram Rammoorthy of Electronics

& Controls, Reverse Auctions have become order of the day which is

being followed by many major banks. The only way customers can be spoken

out of is by explaining the demerits of Reverse Auction and making them

understand. (1) In some tenders, customer is procuring at prices which are

higher than what they would otherwise procure in closed tenders. (2)

Customers are getting supplies which are compromised in terms of

specifications which they are unaware. On the Supplier’s side, (a) the

reverse auctions are just too time consuming, sometimes the process takes

almost a full day, (b) too much dependence on network/internet

connectivity and infrastructure issues (c) Customers themselves setting

unrealistic starting bid prices. Customers have to understand that they

should not buy at very low prices at the cost of suppliers for their own

long term benefit and realize the value for money. As mentioned, Customer

education is key and customers should be open to listening to suppliers,

which they will seldom do. Possibility is for the UPS associations to make

an honest attempt to embark on a sustained plan to educate the Customers.

Though staying away from reverse auctions is an option, a more viable

option is to stick to prices which are viable and sustainable in the long

run.

Mr. Sushil Virmani of Eaton asks Can we find a way out

for UPS Manufacturers staying away from such auctions? Can Customers be

explained the demerits of reverse auction and gain they will have in

normal tendering process. As earlier, I feel that Reverse auction is not

suitable for customized solutions, which is what UPS selling has now

become. We believe that buying UPS starts from conducting a Power audit,

determining specific loads, and then proposing a solution which includes

proprietary software and patented technologies. Mr. Sushil Virmani of Eaton asks Can we find a way out

for UPS Manufacturers staying away from such auctions? Can Customers be

explained the demerits of reverse auction and gain they will have in

normal tendering process. As earlier, I feel that Reverse auction is not

suitable for customized solutions, which is what UPS selling has now

become. We believe that buying UPS starts from conducting a Power audit,

determining specific loads, and then proposing a solution which includes

proprietary software and patented technologies.

In reverse auction the customer compromises on features

of the UPS he is going to purchase, who so ever sells, it the customer who

will loose. A reverse auction bundles apples with oranges, notwithstanding

if it’s appropriate for the buyer or not.

Mr. N P Krishnan, Director Marketing of Consul

Consolidated Pvt. Ltd. Believes that in Reverse auction there is an urge

to become L-1 even if it is at the cost of going down on Bill of

Materials. So all of us must be alert and not bring down prices, just for

the top line. We must mature to the level of ensuring that we don’t cut

each other’s throat. He further adds that the market has been customer

driven and price plays a decisive role in most cases. Can we find a way

out for UPS Manufacturers staying away from such auctions? Can Customers

be explained the de-merits of reverse auction and gain they will have in

normal tendering process. Yes, this is a must. The UPS and battery

suppliers should boycott reverse auctions. The battery suppliers must not

undercut the UPS OEs and go direct to the same customers that UPS OEs

helped develop for the battery suppliers. The UPS industry needs a

complete make-over. All manufacturers must get together and have a common

voice on this. Mr. N P Krishnan, Director Marketing of Consul

Consolidated Pvt. Ltd. Believes that in Reverse auction there is an urge

to become L-1 even if it is at the cost of going down on Bill of

Materials. So all of us must be alert and not bring down prices, just for

the top line. We must mature to the level of ensuring that we don’t cut

each other’s throat. He further adds that the market has been customer

driven and price plays a decisive role in most cases. Can we find a way

out for UPS Manufacturers staying away from such auctions? Can Customers

be explained the de-merits of reverse auction and gain they will have in

normal tendering process. Yes, this is a must. The UPS and battery

suppliers should boycott reverse auctions. The battery suppliers must not

undercut the UPS OEs and go direct to the same customers that UPS OEs

helped develop for the battery suppliers. The UPS industry needs a

complete make-over. All manufacturers must get together and have a common

voice on this.

Softdisk believes that All

said and done, simple way out for UPS companies to avoid getting squeezed

by customers is to boycott all reverse auction.

The Market & Price pressure :

According to Mr. I B Rao & Mr. M R Rajesh of Power

One Micro Systems Pvt. Ltd. today Indian power conditioning market is

getting more sensitive and mature to the evolving needs of the businesses.

With India assuming a key role in the Asian economy, businesses have

become attuned to the fact that they need to be robust in terms of

infrastructure to attract and retain investors. Hence, Business Critical

Continuity is being viewed strategically and upcoming businesses are

realizing the importance of factoring and aligning it as key component in

the overall business model. Adding further they say we view the present

market scenario as an opportunity to strengthen our company’s presence

in Industrial market segment. Extremely low prices are unsustainable if

quality/service levels are to be maintained. Price erosion beyond a point

hurts all stake holders – manufacturers, channel partners, customers,

etc. If it continues beyond a point it will lead to disastrous

consequences for vendors. According to Mr. I B Rao & Mr. M R Rajesh of Power

One Micro Systems Pvt. Ltd. today Indian power conditioning market is

getting more sensitive and mature to the evolving needs of the businesses.

With India assuming a key role in the Asian economy, businesses have

become attuned to the fact that they need to be robust in terms of

infrastructure to attract and retain investors. Hence, Business Critical

Continuity is being viewed strategically and upcoming businesses are

realizing the importance of factoring and aligning it as key component in

the overall business model. Adding further they say we view the present

market scenario as an opportunity to strengthen our company’s presence

in Industrial market segment. Extremely low prices are unsustainable if

quality/service levels are to be maintained. Price erosion beyond a point

hurts all stake holders – manufacturers, channel partners, customers,

etc. If it continues beyond a point it will lead to disastrous

consequences for vendors.

Mr. Ramesh S Managing Director, Powertronix Ltd.,

Bangalore, believes that “In the past year the net materials cost of all

the products gone up and we are taking all cost cutting measures to

control the pricing and offer great value to customers.” We are doing

reverse engineering and research to check all the possibilities to reduce

cost without compromising on quality, he laments. flow going, some people

started quoting very low. But surely they can not repeat and sustain but

certainly some of listed companies could do it for long time. That is to

play a different game to keep the share price high. Even they have to

revert back at some point of time. Mr. Ramesh S Managing Director, Powertronix Ltd.,

Bangalore, believes that “In the past year the net materials cost of all

the products gone up and we are taking all cost cutting measures to

control the pricing and offer great value to customers.” We are doing

reverse engineering and research to check all the possibilities to reduce

cost without compromising on quality, he laments. flow going, some people

started quoting very low. But surely they can not repeat and sustain but

certainly some of listed companies could do it for long time. That is to

play a different game to keep the share price high. Even they have to

revert back at some point of time.

According to Mr. Y B Suresh Small players are finding

it difficult to access to new customer and volume based order because of

the big players are coming out with very competitive price and products

ranges. So, Small player should focus on providing effective service

support to retain their existing and grow in their reference market and

focus on providing complete solution to customers and focus much on

related products requirement in existing customer base. Further to put

more burden we have Reverse Auction Monster. Reverse action is threat not

only to specific industry but it is a common problem faced by all

industries. Unless people in their own industry understands the

seriousness of the problem in its due course and with unity they have to

fight against this otherwise a solution cannot be found. According to Mr. Y B Suresh Small players are finding

it difficult to access to new customer and volume based order because of

the big players are coming out with very competitive price and products

ranges. So, Small player should focus on providing effective service

support to retain their existing and grow in their reference market and

focus on providing complete solution to customers and focus much on

related products requirement in existing customer base. Further to put

more burden we have Reverse Auction Monster. Reverse action is threat not

only to specific industry but it is a common problem faced by all

industries. Unless people in their own industry understands the

seriousness of the problem in its due course and with unity they have to

fight against this otherwise a solution cannot be found.

We are focusing on diversified market segment like

solar PCUs and closely working with few OEM buyers in that segment and

working on new design to reduce cost of production and support small time

OEM buyers. According to Mr. Shankar C Nagali of Managing Director of

Cosmic Micro Systems, India’s GDP growth despite slowdown is currently

hovering around 4-6 percent mark which gives us an indication of the

industrial expansion that is already happening at a rapid pace. The

rigidity of the Indian economy was reflected during global meltdown. We are focusing on diversified market segment like

solar PCUs and closely working with few OEM buyers in that segment and

working on new design to reduce cost of production and support small time

OEM buyers. According to Mr. Shankar C Nagali of Managing Director of

Cosmic Micro Systems, India’s GDP growth despite slowdown is currently

hovering around 4-6 percent mark which gives us an indication of the

industrial expansion that is already happening at a rapid pace. The

rigidity of the Indian economy was reflected during global meltdown.

As UPS category rate in an economy that is already the

world’s fourth largest in real terms (Purchasing Power Parity) is

expected to grow the faster then any other country barring China. The key

factors for India’s growth in the UPS market are would be:

Increase in PC & server sales resulting in

increased demand for UPS.

Increased penetration in B, C & D class cities

has been another reason for the

category growth.

Growth in the economy will lead to the growth and

increase in IT spends of vertical like IT, ITES, manufacturing, BFSI and

Government. There by leading to the increased demand for the UPS systems

in these vertical.

Increased awareness for quality of power has also

boosted the demand for UPS systems. UPS provides protection against

voltage fluctuations and low voltage. Increased awareness for quality of power has also

boosted the demand for UPS systems. UPS provides protection against

voltage fluctuations and low voltage.

Let’s understand UPS as vital link in the process

chain, not as an end product. It should the part of the solution not the

part or source of the problem. The only way to match Chinese prices is

being a Chinese; by supplying opportunity based solutions, which is not

what Indian environment needs. But if we are talking about reliable,

economical, value for money products I think many Indian manufacturers

have almost achieved it except for lower capacities where there are huge

volumes.

NORMS OF THIRD PARTY MAINTENANCE

According to Mr. Rajaram Rammoorthy Third Party

Maintenance is a concept that Customers have patronized for their own ease

of getting support through a single supplier. It is difficult to get

consensus among UPS manufacturers as many of them are hard pressed for

revenues and not lose opportunities. Even if one supplier takes the

service support of several brands, it is cumbersome to subcontract and get

the services done given the numerous brands the customer may have bought

over a period of time. Customers have to be educated that maintenance

through original supplier will be beneficial to them in the long run and

realize the maximum return on their investment. Alternately, the unity in

the industry should be very high to not take other brands for maintenance,

which is a dream.

Rabindra Agarwal of Switching AVO, Kolkatta believes

that it is common knowledge that, though UPS being a proven technological

concept, differs in its construction based on manufacturer. Components for

spares sometimes become inaccessible leading to servicing difficulties

resulting in replacement of a UPS with another equivalent product. This

method proves costly for the maintenance vendor and the customer loses the

original asset quality which is not clearly visible during the life of the

maintenance contract. This is a perceived loss to the customer. UPS OEMs

on the other hand lose their valuable service revenue which was hitherto

their assured income, which is now being threatened. This unhealthy

practice is being practiced by most UPS OEMs, and as a matter of

safeguarding their own interests and incomes. Refraining others from

taking maintenance of other makes is difficult to implement, as there are

numerous unorganized players. Customers should also verify the claims of a

third party service company about their capability to service other makes

as the absence of that could lead to a huge loss to them in the form of

degraded product / performance and damage the operational efficiency of

their organization leading to fresh purchase. Rabindra Agarwal of Switching AVO, Kolkatta believes

that it is common knowledge that, though UPS being a proven technological

concept, differs in its construction based on manufacturer. Components for

spares sometimes become inaccessible leading to servicing difficulties

resulting in replacement of a UPS with another equivalent product. This

method proves costly for the maintenance vendor and the customer loses the

original asset quality which is not clearly visible during the life of the

maintenance contract. This is a perceived loss to the customer. UPS OEMs

on the other hand lose their valuable service revenue which was hitherto

their assured income, which is now being threatened. This unhealthy

practice is being practiced by most UPS OEMs, and as a matter of

safeguarding their own interests and incomes. Refraining others from

taking maintenance of other makes is difficult to implement, as there are

numerous unorganized players. Customers should also verify the claims of a

third party service company about their capability to service other makes

as the absence of that could lead to a huge loss to them in the form of

degraded product / performance and damage the operational efficiency of

their organization leading to fresh purchase.

However Mr. Sumanth Kumar of Powernet has a different

opinion, if the original manufacturer is providing proper service at

proper price, customer may not look for a third person to get the support.

One can think by common sense it is easy for original manufacturer to

provide better service at better price than the third person. So if we try

to make the manufacturer to reject the offer will lead to a monopoly for

the manufacturer and disadvantage to the customer, no one will refuse on a

written format and same time he may charge the customer heavily or take a

ride on customer. So keeping our customers with us is mainly depends on

the original supplier, so we should consider it as more responsibility

than a birth right. Always working with responsibility will take you long

journey than working with rights. Mr. Sumanth Kumar of Powernet Solutions

Pvt. Ltd. Adds “all manufactures have to unite on this, Specifically for

capacities above 5 kVA/10 kVA and to adhere to this in the interest of the

client and the suppliers. Generally as a manufacturer we maintain spares

for the next 8 years from the date supply.” However Mr. Sumanth Kumar of Powernet has a different

opinion, if the original manufacturer is providing proper service at

proper price, customer may not look for a third person to get the support.

One can think by common sense it is easy for original manufacturer to

provide better service at better price than the third person. So if we try

to make the manufacturer to reject the offer will lead to a monopoly for

the manufacturer and disadvantage to the customer, no one will refuse on a

written format and same time he may charge the customer heavily or take a

ride on customer. So keeping our customers with us is mainly depends on

the original supplier, so we should consider it as more responsibility

than a birth right. Always working with responsibility will take you long

journey than working with rights. Mr. Sumanth Kumar of Powernet Solutions

Pvt. Ltd. Adds “all manufactures have to unite on this, Specifically for

capacities above 5 kVA/10 kVA and to adhere to this in the interest of the

client and the suppliers. Generally as a manufacturer we maintain spares

for the next 8 years from the date supply.”

Mr. N P Krishnan of Consul also agreed, he believes

otherwise fly by night operators would flourish.

Softdisk believes that UPS Manufacturers should come up

with SAY No To TPM, unless the company that had sold the machine refuses

to maintain the machine. This should be binding on all Manufacturers. This

practice if persuaded with not only make Servicing an assured income and

bring revenue to the company on the other hand customer will have longer

life for its system as similar & not substitutes parts will be used to

replace the faulty component.

ON THE TAXATION FRONT

Divergent view were expressed by on taxation front.

Where one segment believes that UPS imports should be exempted for taxes

the segment talks of protecting the interest of Indian UPS Manufactures.

According to Mr. I B Rao of Powerone Micro Systems Pvt.

Ltd., Bangalore believes Govt. should considering the importance of UPS

systems in a growing economy and keeping in view the power Scenario what

it is, the Govt. should certainly exempt all UPS systems from import

duties Customs Duties, excise duties etc. Although “The government is

quite conscious of the power scenario in the country, yet it seems that

all the new addition to the installed capacity do not gives us the comfort

of continuous power even by the year 2013. Despite this grave situation,

there are no special incentives or support for the UPS installation except

in a very limited way. Considering the importance of UPS Systems in a

growing economy and keeping in view the power scenario what is it, the

Govt. should certainly exempt all UPS Systems from import duties and

excise duties” , he laments. According to Mr. I B Rao of Powerone Micro Systems Pvt.

Ltd., Bangalore believes Govt. should considering the importance of UPS

systems in a growing economy and keeping in view the power Scenario what

it is, the Govt. should certainly exempt all UPS systems from import

duties Customs Duties, excise duties etc. Although “The government is

quite conscious of the power scenario in the country, yet it seems that

all the new addition to the installed capacity do not gives us the comfort

of continuous power even by the year 2013. Despite this grave situation,

there are no special incentives or support for the UPS installation except

in a very limited way. Considering the importance of UPS Systems in a

growing economy and keeping in view the power scenario what is it, the

Govt. should certainly exempt all UPS Systems from import duties and

excise duties” , he laments.

Legrand intends to accelerate the growth of its brand

by sustained investment, launch of new products, and focus on growing the

market backed by the pan India sales and service network. According to Mr.

Marc Werle, CEO (UPS OPERATIONS) Legrand, we are also backing up the same

with dedicated global R&D team to support the launch of the state of

the art UPS for the Indian market in the coming months. The challenge

being faced by most manufacturers has been the weakening of the Indian

Rupee against the US Dollar which is the concern for importers and the

policies of the Government recently to accelerate investment in Retail and

Industrial verticals will certainly support the industry and its growth.

With the existing power situation not improving the UPS industry can

witness a positive growth in the coming months ahead. Legrand intends to accelerate the growth of its brand

by sustained investment, launch of new products, and focus on growing the

market backed by the pan India sales and service network. According to Mr.

Marc Werle, CEO (UPS OPERATIONS) Legrand, we are also backing up the same

with dedicated global R&D team to support the launch of the state of

the art UPS for the Indian market in the coming months. The challenge

being faced by most manufacturers has been the weakening of the Indian

Rupee against the US Dollar which is the concern for importers and the

policies of the Government recently to accelerate investment in Retail and

Industrial verticals will certainly support the industry and its growth.

With the existing power situation not improving the UPS industry can

witness a positive growth in the coming months ahead.

Softdisk magazine does a thorough analysis of the UPS

industry and provides detailed information on the various players, rating

& ranking them on their various important parameters than any other

agency. We thank Softdisk for their dedicated efforts from 1993 to bring

up the Indian UPS Industry to a status of recognition from where it was in

the early 90's.

According to Mr. Nikhil Pathak VP, India & SAARC,

Schneider Electric, We derive 36% of our business from emerging economies,

and India is our focus market for BRIC in end-to-end power solutions

offering, which caters to enterprise, SMBs and SOHO, data centre segments.

In the last four years, our group has built around 50 data centres in

India and we have proved to offer 30% less energy consuming data centres

with our racks, UPS and cooling solutions. Our growth story is robust in

Indian market. According to Mr. Nikhil Pathak VP, India & SAARC,

Schneider Electric, We derive 36% of our business from emerging economies,

and India is our focus market for BRIC in end-to-end power solutions

offering, which caters to enterprise, SMBs and SOHO, data centre segments.

In the last four years, our group has built around 50 data centres in

India and we have proved to offer 30% less energy consuming data centres

with our racks, UPS and cooling solutions. Our growth story is robust in

Indian market.

Mr. Balan of Numeric UPS suggests to have a common

taxation structure for UPS System across India so that the same rate of

tax is followed across India. This is beneficial to the customer and to

the Government. Different tax rates makes the product unnecessarily

costlier to the enduser (customer) as the one who is paying the taxes.

Vinod Kumar of ARVI is in the process of setting up of

100% EOU for exporting Online UPS and solar solutions. ARVI will be

launching solar solution of irrigational purpose very soon, which has a

huge potential apart from enhancing its market share in niche products

specially designed for medical and industrial sectors for critical

applications. He also believes that Immediate implementation of GST on the

tax front is absolutely essential.

CONCLUSION :

Softdisk believes that being a negligible contributor

to the GDP, Power Electronic Industry does not receive enough attention

from the Govt., we believe the Govt. should realize the importance of

Power Continuity as it is the life line of major GDP contributors.

Softdisk has seen it all over the past two decades, more often then not

some of the companies use a lot of word jugglery in there promos, it must

be the same thing which some one else must be offering without making lot

of noise and at a better price. It is one area where customers need to be

watchful. Softdisk believes that being a negligible contributor

to the GDP, Power Electronic Industry does not receive enough attention

from the Govt., we believe the Govt. should realize the importance of

Power Continuity as it is the life line of major GDP contributors.

Softdisk has seen it all over the past two decades, more often then not

some of the companies use a lot of word jugglery in there promos, it must

be the same thing which some one else must be offering without making lot

of noise and at a better price. It is one area where customers need to be

watchful.

Softdisk believes that if Manufacturers mad rush for

sale at any cost continues, one cannot expect a growth of 25-30% as it

used to be but settle for 6-8% growth, at-least for next two years, unless

some thing miraculous happens. So UPS business is not rosy and bright but

has still not lost its potential. |